International money transfer – send money safely for less

Use our international money transfer tool to see what you’ll get for your money based on your plan

- Simple

- Classic

- Premium

| Rate | 1 GBP = 1 EUR |

| Transaction fee | £ 1 |

Sign up for a Monese account

Download the app today to start spending and sending with Monese.

Loved by many

Here's what our customers are saying

Excellent international exchange rates

Count on money-saving exchange rates when you send money home with our mobile money transfer service. We use real-time, wholesale exchange rates. You’ll find we’re often far cheaper than sending money abroad with traditional banks.

A safe international money transfer app

Making an international money transfer online is safe with Monese. Security is at the heart of everything we do. Our mission is to protect your money and personal data. We offer single-device access to your Monese account, secure login and strong multi-factor encryption and authentication protocols plus 24/7 state-of-the-art monitoring.

Fast mobile money transfers of all kinds

Set up fast transfers of all kinds, including local and cross-border payments. If your transfers are between Monese accounts, they’re free and instant, no matter the currency.

Send money abroad to these locations

Whether you want to make a money transfer to Europe, Asia, South America or elsewhere, you can. Choose the country you need and send money quickly at great rates — straight from your phone!

Send money toAustralia

Send money toAustria

Send money toBelgium

Send money toCanada

Send money toCyprus

Send money toCzech Republic

Send money toDenmark

Send money toEstonia

Send money toFinland

Send money toFrance

Send money toGermany

Send money toGreece

Send money toHong Kong

Send money toHungary

Send money toIndia

Send money toIreland

Send money toItaly

Send money toLatvia

Send money toLithuania

Send money toLuxembourg

Send money toMalta

Send money toMexico

Send money toNetherlands

Send money toNorway

Send money toPhilippines

Send money toPoland

Send money toPortugal

Send money toRomania

Send money to Singapore

Send money toSlovakia

Send money to South Africa

Send money toSpain

Send money toSweden

Send money toUnited States

Send money abroad

Choose the country you want to send money to quickly and at great rates — straight from your phone!

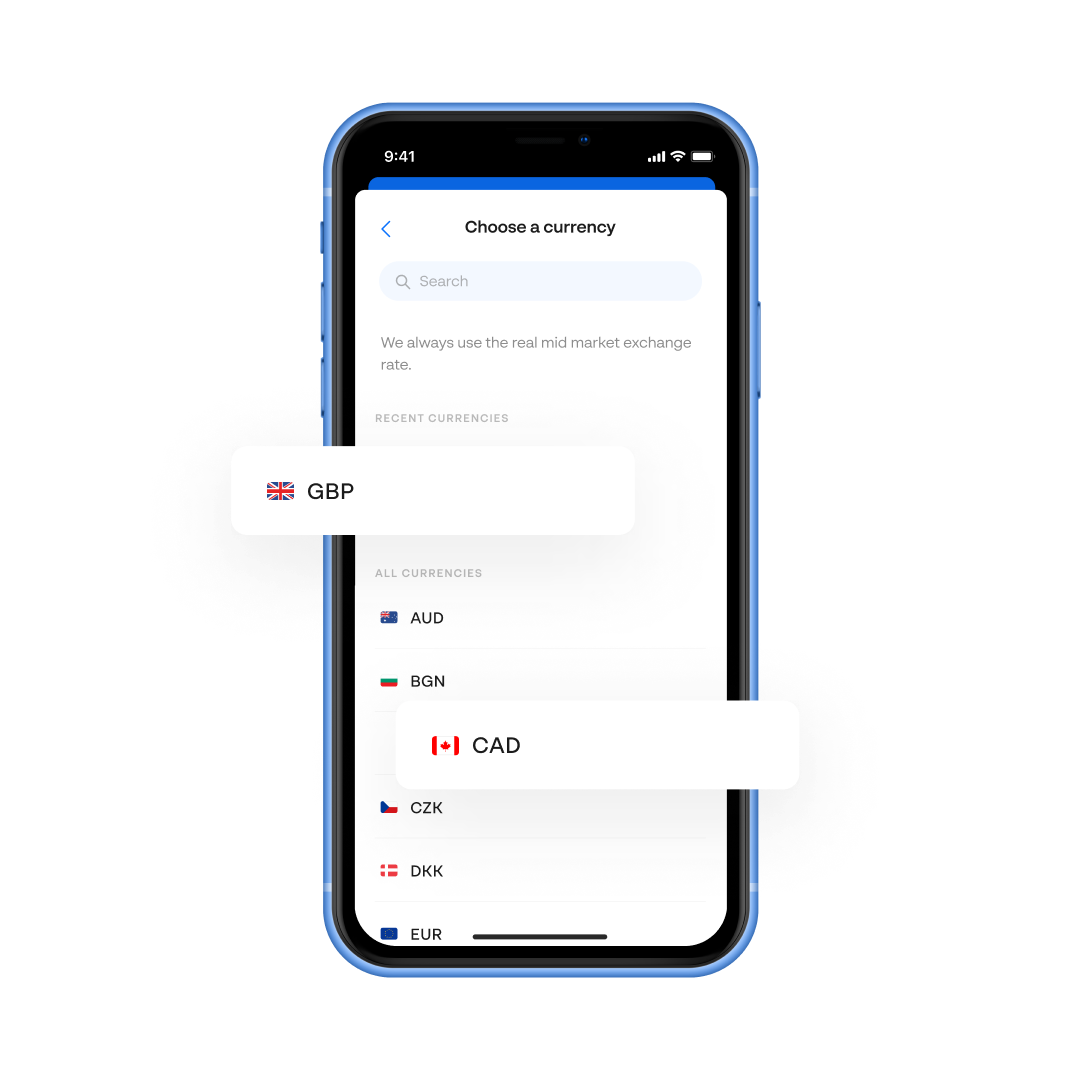

Send money to another currency

Want to choose a currency instead? You can see them all by using our money transfer tool at the top of this page. And be sure to check back regularly because we’re always adding more!

How to use our international money transfer app

Our money-saving international money transfer service is quick and easy to use.

1. Sign up for a Monese account

Download our app and sign up for a Monese account with a few basic details. Opening an account is quick and easy.

2. Choose the Pay option

Choose the Pay option on the bottom menu of your Monese app.

3. Choose who you’re sending to

Tap ‘New payment’ and enter your recipient’s details — or quickly choose someone you’ve paid before, or someone in your Monese contacts.

4. Enter how much you want to send

Tell us the amount you want to send. We’ll show you our fees upfront, which vary depending on your Monese plan.

5. Match the currency

Make sure the currency matches your destination, like sending INR to India. This is because we use peer-to-peer money transfer services.

6. Approve your payment

Check the details are correct, approve your payment, and let us take care of the rest. You can make changes first if you need to.

Our customers love us

Here's what they're saying

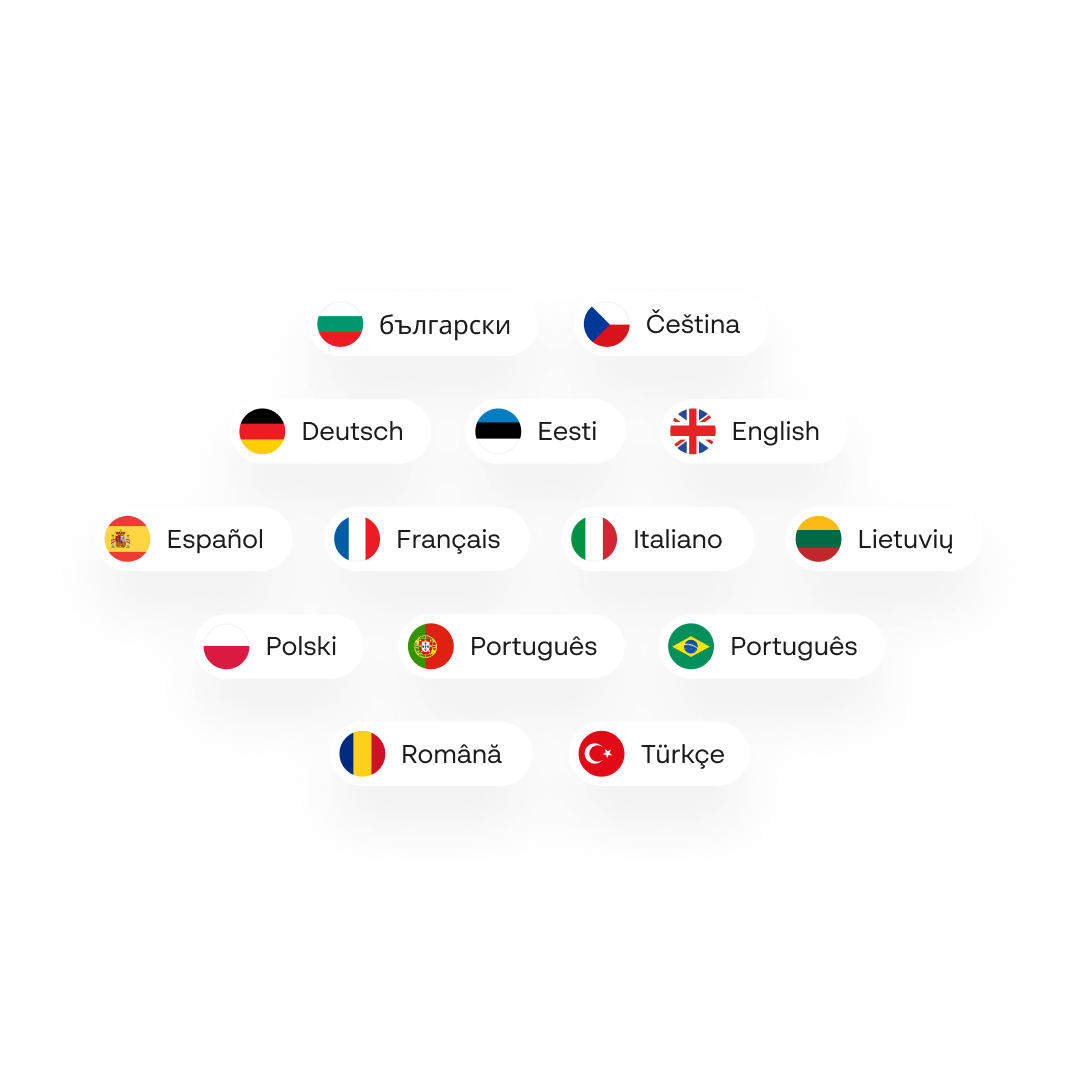

Join the international Monese community

Join over 2 million people worldwide who are managing their money online with Monese. You can use our app in 14 languages and our friendly Support team are multilingual too. Our mobile money transfer service is just one reason why our customers say we’re great!

International money transfer FAQs

Got a question? From our FAQs to our multilingual Support team, there are lots of ways we can help. You might find an answer in the international money transfer FAQs below or in our latest money transfer articles.

What is an international money transfer?

Who can make a mobile money transfer?

How long does an international money transfer take?

Is making an international money transfer online safe?

How can I make a cheap international money transfer?

Is there a limit on how much money I can send abroad?

How do I receive an international money transfer?

Why make an international money transfer with Monese?

Sign up for a Monese account now

Start saving and sending money abroad with Monese today! Download our easy international money transfer app to join now in minutes.