Recently relocated? Start building your financial future today

Why credit score is important in the UK

Improve your UK credit score

Build your credit history hassle and interest-free, without the need to apply for a high-interest credit card, with the Monese Credit Builder, available on all plans for customers in the UK.

**Representative APR: The loan, as a part of the Credit Builder service is a 0% interest loan, but in financial jargon the £2.50/month subscription fee relates to a 9.10% APR as that is the cost of your Credit Builder. This is based on a loan amount of £600.

Secure your financial future and start building your credit history hassle and interest-free, without the need to apply for a high-interest credit card and payday loans. The Monese Credit Builder is available on all plans for customers in the UK for just £2.50 a month (Rep APR 9.10%)*.

*Representative Example: The loan as a part of Credit Builder is a 0% interest loan, but the £2.50/month subscription fee relates to a 9.10% APR as the cost of your Credit Builder. Based on a loan amount of £600.

Why your credit score matters

Your credit history is your financial footprint in the UK and what helps determine your credit score. Essentially, it’s what’ll put you on the financial map and radar of UK credit agencies. Why is this important? Newcomers to the UK with no credit history will quickly find that a lack of it will make it difficult to rent a flat, buy a car or even get a mobile contract. And much like trying to open a bank account as a foreign national, getting a credit card to build bad credit or to start building history and improving your credit score can throw people into quite a loophole. It can be difficult to obtain due to lack of documents – and yes, even credit history. That’s where our easy Credit Builder can help.

Build your credit history hassle and interest-free, without the need to apply for a high-interest credit card, with the Monese Credit Builder, available on all plans for customers in the UK.

**Representative APR: The loan, as a part of the Credit Builder service is a 0% interest loan, but in financial jargon the £2.50/month subscription fee relates to a 9.10% APR as that is the cost of your Credit Builder. This is based on a loan amount of £600.

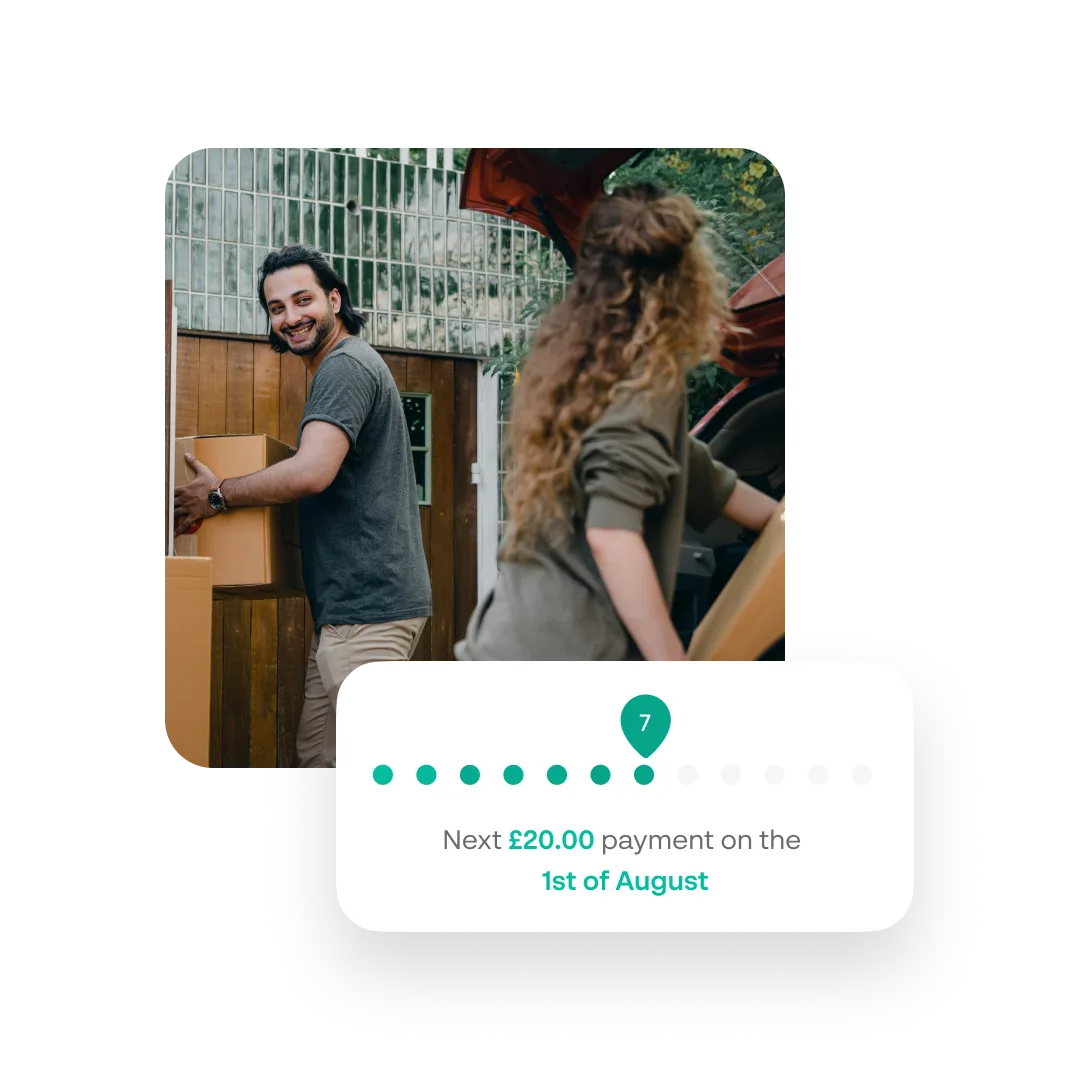

Build credit today while saving for tomorrow

The way our Credit Builder is set up, you’ll be saving while building your credit history and improving your credit score all at the same time. After a year of monthly repayments on your interest-free Credit Builder loan, you’ll have 12 months of successful repayment history recorded with the credit agencies, plus 12 months of savings ready to spend!

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Improve your score where it counts

With our no credit check Credit Builder, rest easy knowing that your monthly repayments are reported to all three of the UK’s main credit agencies: Experian, Equifax and TransUnion, where you’ll start seeing a difference in your credit score. You’ll eventually be able to get a loan, rent a home, start your small business or buy any other big-ticket items with your higher score. With an improved credit score thanks to our Credit Builder, you’ll be eligible for a wider range of better value loans, credit and rates in the future.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

How to build and get started

Step 1:

Open your app to start building. Head to the ‘Explore’ tab and select ‘Credit Builder’ to easily set up and start building your credit history and score.

Step 2:

Decide how much you want to save. Choose a fixed repayment amount you can realistically afford to pay back each month, between £30 to £100.

Step 3:

Make your repayments and save. Make your repayments each month for a year to pay off your interest-free Credit Builder loan. We’ll report your repayments to the 3 agencies.

Step 4:

Unlock your savings. After 12 months of a successful repayment history built up, your personal Credit Builder pot will be unlocked, ready to spend!

Unlock access to other Monese credit products

With the savings you’re building, you’ll be able to unlock and access other credit products down the line.

Secure your financial future today

Start your new life in the UK with your best foot forward. Download our app to start on your credit journey in the UK and build your financial footprint.

Building your credit score doesn’t need a high-interest credit card or costly payday loans that you keep getting turned away from anyway. Instead, start building your credit score in the UK (hassle and interest-free with no credit check!) with the Monese Credit Builder. Available on all plans for customers in the UK for just £2.50 a month (Rep APR 9.10%)*

*Representative Example: The loan as a part of Credit Builder is a 0% interest loan, but the £2.50/month subscription fee relates to a 9.10% APR as the cost of your Credit Builder. Based on a loan amount of £600.

Credit Builder Help

Your credit score is a measure used by financial institutions and banks to rate your ability to pay back potential loans or credit you take based on your credit history. It measures how well you handle your financial commitments. The higher your credit score is, the better credit offers you may receive from potential lenders.

Your credit history is your repayment history on credit commitments over the last six years and is used to determine your credit score. It may include the number and types of credit accounts, amount of available credit you’ve used and number of recent credit enquiries. It’ll contain details on your:

- regular repayments

- amounts repaid

- outstanding amounts

- number of creditors

Credit Builder is available on all plans for £2.50/month to all UK-based customers with a Monese GBP account and aged between 18–75. If you’re eligible for the Credit Builder, you’ll see the option in your Monese app under the Explore section: Monese app > your GBP account > Explore tab > Credit Builder.

Right in your Monese app, you’ll be able to choose a fixed amount to repay each month, between £30 to £100. Depending on the amount you pick, we’ll use this to create an interest-free Credit Builder loan and lock this away in your Credit Builder pot. Your Credit Builder loan is equal to 12 months of your repayments. So for example, if you decide you can afford to repay £30 per month for a year, this will result in a total loan of £360 in your locked pot. This pot will only be unlocked following your last (12th) repayment.

As you pay off your interest-free credit builder loan each month, you work towards getting your Credit Builder pot unlocked. We’ll report these monthly payments to the three UK credit agencies to help build and improve your credit history and score. After a year, your interest-free loan will be fully repaid. This means you’ll have 12 months of successful repayment history recorded with the credit agencies, and your pot will be unlocked, ready to spend!

Right in your Monese app, you’ll be able to choose a fixed amount to repay each month, between £30 to £100 for a minimum borrowed amount of £360 to a maximum of £1,200.

The amount of your interest-free credit loan (i.e., what you borrow) should be driven by how much you can realistically commit to repay monthly and should never be higher than your monthly disposable income. A higher amount doesn’t necessarily mean you’ll have a better credit score. The best value of the Credit Builder lies in being able to make your repayments on time, without any financial difficulties.

If you miss a payment, we’ll need to report your account in arrears to the credit agencies. We’ll give you the ability to catch up on missed payments, but missing payments can have a big negative impact on your credit score and history. Once you miss 4 consecutive payments we will Default your Credit Builder and automatically and return all the payments you’ve made to your Monese GBP account.

Even though Monese Credit Builder is an interest-free loan, there’s still a subscription fee associated with using the Credit Builder feature. This helps us cover costs like managing your Credit Builder loan, keeping security held against your loan and the reporting services to all three credit agencies.

Due to the FCA regulatory requirement, any fees associated with the loan need to be included in APR. This is why the subscription fee is used to calculate the APR of your Credit Builder loan.

For example, if you save £50 a month, your Credit Builder will automatically issue you a £600 loan (£50 x 12). Because you’re paying £2.50 per month for the Credit Builder service, the total cost of credit is £30 (£2.50 x 12) over the term of the loan. This equates to an APR of 9.10%

Want to learn more about credit builders and our credit building tools? Find out more of our bitesize videos here.

This service is arranged by Monese Finance Ltd. Monese Finance Ltd is a broker and not a lender, and is an appointed representative of Resolution Compliance Limited which is authorised and regulated by the Financial Conduct Authority (FRN:574048). The credit builder loan is provided by Monese Credit Limited which is authorised and regulated by the Financial Conduct Authority (FRN:787052).